|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

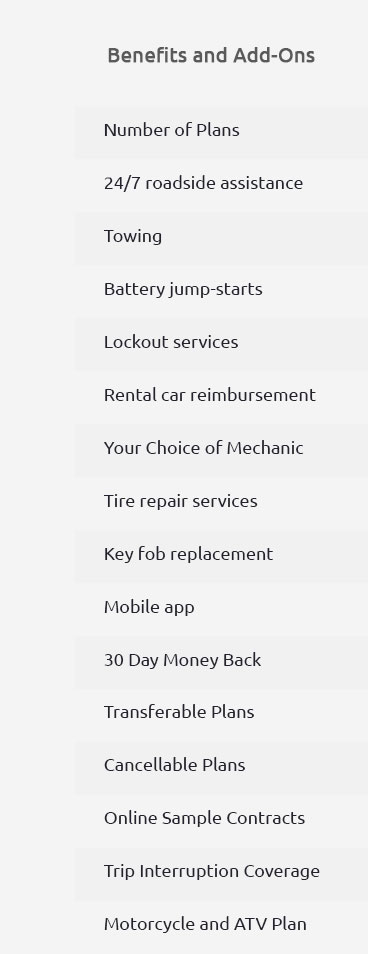

Who Does Gap Insurance: A Comprehensive Coverage GuideFor U.S. consumers navigating the complexities of vehicle protection, understanding gap insurance can offer peace of mind and significant cost savings. Gap insurance covers the 'gap' between what you owe on your vehicle and its actual cash value in the event of a total loss. This coverage is particularly beneficial if you have a long-term loan or lease, protecting you from unexpected financial burdens. Understanding Gap InsuranceGap insurance is a financial safeguard that can be added to your auto insurance policy. Its primary purpose is to cover the difference if your car is totaled or stolen, and you owe more than its depreciated value. In places like California and New York, where vehicle costs are high, this can be especially valuable. Benefits of Gap Insurance

Gap insurance is an excellent complement to other coverage options, like an Infiniti vehicle warranty, which can protect against costly repairs. Who Provides Gap Insurance?Several providers offer gap insurance in the U.S., including car dealerships, insurance companies, and banks. While purchasing gap insurance through your auto insurer is often the most convenient option, banks and credit unions may offer competitive rates. Considerations for Purchasing

FAQs About Gap Insurance

What does gap insurance cover?Gap insurance covers the difference between your car's actual cash value and the amount you owe on your auto loan or lease. Do I need gap insurance if I have a car repair guarantee?Even with a car repair guarantee, gap insurance is advisable if your car is financed or leased to cover the outstanding loan balance in case of a total loss. How long do I need gap insurance?You need gap insurance until your loan balance is lower than the vehicle's value. This can vary based on your loan term and vehicle depreciation. In conclusion, gap insurance offers essential protection for those with financed or leased vehicles. By covering the gap between your car's value and what you owe, it ensures financial stability and peace of mind. Whether in bustling cities like California or rural areas, the benefits of gap insurance remain universally valuable. https://www.experian.com/blogs/ask-experian/what-is-gap-insurance/

Gap insurance covers the "gap" between what your regular insurance policy pays and what you owe on your auto loan if your car is totaled or ... https://www.sccu.com/articles/auto/what-is-auto-loan-gap-insurance

A GAP policy will ensure that you will receive the difference between the outstanding balance on your loan and your auto's actual cash value (ACV). https://www.biggerschevy.com/finance/car-buying-tips/what-is-gap-insurance/

GAP insurance stands for Guaranteed Asset Protection, and helps cover the gap between your vehicle's worth and the amount of money you owe on your auto ...

|